Trends to watch in tomorrow’s Workers’ Comp market

ArticleOctober 28, 2021

by Alex Wells, Head of U.S. Middle Market, Zurich North America

This article is the third in a series focusing on the current and historical trends for various commercial insurance products. Other articles focus on Commercial Automobile and General Liability.

Trends in Commercial Insurance, Issue 3 of 4: Workers’ Compensation

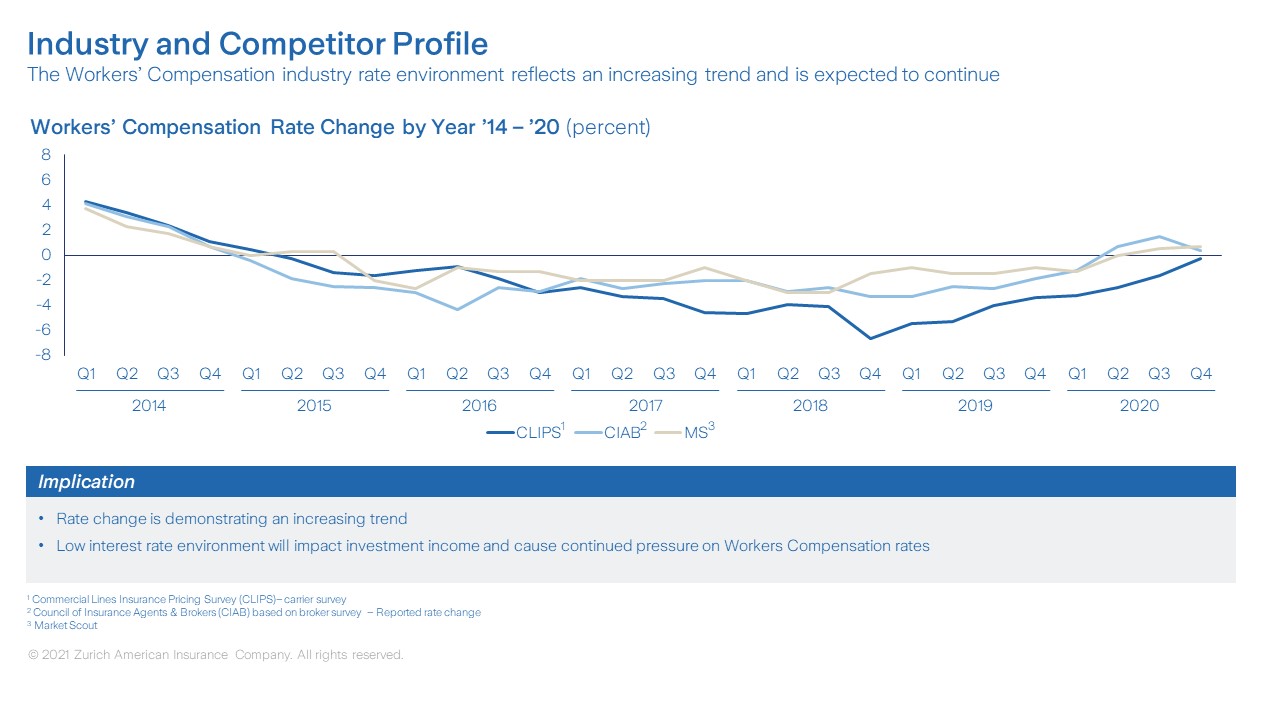

Like other lines of business insurance, Workers’ Compensation prices and performance have historically been affected by an “underwriting cycle” driven by the ebb and flow of markets in transition. Today, however, the Workers’ Compensation line of business is experiencing what some are calling an “atypical market” environment. The insurance industry continues to operate in a very low interest rate environment, with stable or slightly reduced rates in the Workers’ Compensation line. This type of Workers’ Compensation market has been in place for five years and all indications are that it will continue into 2022 with small exceptions in specific industries. While a period of price competition is seen as attractive from the customer’s point of view, an extended flat pricing environment usually signals deteriorating results for insurers as rates fail to keep pace with loss trends and inflation. Yet, today’s Workers’ Compensation line remains profitable, delivering favorable combined ratios overall. In fact, industry combined ratios have steadily improved since the late 1990s, when some carriers’ combined ratios spiked over 120 percent.

Predicting the direction of the market for any line of business will take is usually a best-guess scenario based on historic loss data and what we know about developing marketplace trends. The only certainty is that the Workers’ Compensation market will undergo change. The amount of change will depend upon the relative impact of a variety of trends that underwriters are watching closely. These trends include:

Telemedicine services — A valuable tool supercharged during Covid: While the use of telemedicine predates COVID-19, the pandemic prompted a significant increase in the utilization of telemedicine services associated with Workers’ Compensation claims. According to one telehealth tracking organization, telehealth claims lines increased by an astonishing 4,347%, an incredible rise from 1.17% in March 2019.1

Zurich’s experience with telemedicine mirrors the positive trends being experienced by the Workers’ Compensation industry at large. From the employer’s perspective, telemedicine provides employees with professional consultations they need while reducing the time away from work traveling to medical appointments. In addition, telemedicine has been instrumental in allowing injured workers to access the treatment and advice they need while avoiding the risks associated with in-person visits during the pandemic. According to the National Council on Compensation Insurance (NCCI), it remains an open question to what degree COVID-19 will continue to impact the utilization and accessibility of telemedicine services for Workers’ Compensation cases, including to what extent states may enact permanent telemedicine regulations and provisions.2

Use of topical analgesics — A necessary but expensive alternative to opioids: As the use of opioid-based pain meds has come under increasing scrutiny, controversy and legislative action related to the U.S. opioid crisis, tighter restrictions on when and how they are to be prescribed has begun to reduce their availability. As a result, topical analgesics have become important options for treating musculoskeletal and neuropathic pain conditions related to Workers’ Compensation claims, and hence a growing prescription cost driver. A recent Workers’ Compensation Research Institute (WCRI) drug trends report indicated that the payment share for topicals in a typical state increased from 9% in the first quarter of 2015 to 19% in the first quarter of 2020.3

We anticipate the prescription and use of increasingly expensive topical analgesics to continue in the Workers’ Compensation environment as controls over opioids tighten.

Mega claims — A broad severity trend impacting all casualty lines: So-called mega-claims are large Workers’ Compensation cases that typically involve serious injuries or work-related illnesses amounting to $3 million or more. While construction-related claims lead the pack, sometimes generating large claims of $10 million and higher, any and all business segments may be at risk — from manufacturing and retail to transportation, office and clerical exposures.4

According to the Insurance Research Council, the key drivers of mega claims are largely attributable to social inflation, the meteoric growth in liability risks and costs related to litigation trends.5 I commented on this issue in my prior trends articles in this series, Commercial Automobile and General Liability. The Workers’ Compensation line of business is also susceptible to the rising litigation-industrial complex that fuels attorney advertising, large jury verdicts and mass torts, making it even more critical for employers to adjust their risk mitigation strategies as a first line of defense.

Continued impacts of COVID-19 — Is Covid temporary or endemic?: According to the NCCI, pandemic-related issues will remain a top concern of Workers’ Compensation insurers and customers in the months ahead.6 There are concerns whether COVID-19 compensability enacted in some states will become permanent or may even extend to other diseases. The number of laws and executive orders providing compensability for workers who might acquire COVID-19 on the job may differ greatly from one state to another. Further, there are still open questions about the potential for compensable injuries and issues related to worker safety with more employees working from home.

In addition, there is the question of COVID-19 long-haulers and extended periods of chronic disability due to the aftereffects of an infection. If an infection is found to be compensable as work-related, is long-haul COVID-19 then a qualified long-term disability?

Workplace-related mental injury — An additional outgrowth of Covid: Earlier this year, NCCI noted that the group was monitoring approximately 40 proposed state bills addressing Workers’ Compensation for mental injuries, including more than 30 bills related to post-traumatic stress disorder (PTSD).7 While states differ in how they define “mental injury,” it is becoming clear that finding such injuries compensable as work-related may be the next frontier in Workers’ Compensation.

Workforce evolution — The changing future of work: Even before the onset of the pandemic, for many companies the workplace was already evolving, driven by new technologies and changing perspectives of the importance of work-life balance, the latter manifested in calls for greater flexibility in scheduling and working from home.8 As we have seen, the pandemic drove change at a pace never before seen, with some companies’ entire teams working remotely for many months. As we look ahead post-pandemic, many workplaces will now operate under a hybrid model in which some employees may opt to return to a five-day, on-site working environment, while others, enabled by technology, will continue to work mostly, or perhaps entirely, from remote locations. What long-term impacts will this evolution have on the Workers’ Compensation model and marketplace?

In addition, the U.S. workforce is likely to get younger and less experienced as older workers who were thinking about retiring have moved their timetables up due to the pandemic. And the current worker shortage and intense competition among businesses for the people and talent they need is likely to continue and intensify. Will an influx of younger and less experienced workers more prone to injuries mean that accidents and claims will increase, including disabilities that might last years longer due to an employee’s youth at the time of an accident or illness?

Get ahead of future Workers’ Compensation trends

As I noted at the beginning of this article, the current, atypical market environment for Workers’ Compensation insurance has been favorable for both customers and insurance carriers. But, as in all things, change is inevitable. The trends outlined in this discussion are just some of the factors that may impact Workers’ Compensation insurance in the years ahead. Some trends, such as increased use of telemedicine services to facilitate consultations between injured workers and medical providers, may have distinctly positive impacts on costs and outcomes. Others, such as an unfettered litigation climate and increasing medical inflation, will most likely shape the environment in less positive ways.

No matter how these and other factors may affect the trajectory of Workers’ Compensation costs in the future, one thing is certain. Customers want and need stability and predictability in the ultimate cost and availability of this critical insurance product. And while broader, macro-trends influencing the industry remain largely beyond the control of individual customers, a variety of actions exist within their spans of control that can positively affect Workers’ Compensation costs.

The most immediate and impactful way to reduce costs is to do everything you can to ensure that you are providing your employees with a safe and healthful workplace. Promoting and training worker safety best practices will differ depending on the nature of your business. A manufacturing plant with production machinery is going to have a hazard profile quite different from an office exposure. But formal training and safety awareness programs attuned to the needs of a particular workplace will be equally important in any working environment.

The implementation of employee wellness and health promotion programs, including everything from workplace ergonomics training to reduce repetitive movement injuries to Employee Assistance Programs (EAPs) to help workers deal with stress, can have a measurable, positive impact on Workers’ Compensation results. And that, of course, can affect what your insurance costs will be in the long run.

Working with an insurance carrier with a strong occupational safety and risk engineering orientation will also be a great help in identifying and assessing workplace hazards that may be causing employee injuries and illnesses. The first and most important step in mitigating a problem is knowing that it exists. A qualified, experienced risk engineering professional will help identify your risks and offer recommendations to prevent accidents and loss events.

Maintaining a safe and productive workplace is one of your most important business goals and ethical responsibilities. Working in concert with your broker and Workers’ Compensation insurance provider, you can build an occupational safety and health environment for your people that will help you weather whatever effects the winds of change may have on the marketplace.

Other trends articles by Alex Wells:

- Commercial auto insurers face an environment of continuing challenges

- Several trends that will impact the course of general liability insurance in the years ahead

References

1. Pollock, Ted. “Three key 2021 workers’ compensation trends to watch.” NU Property-Casualty 360. 18 January 2021.

2. Kersey, Laura. “2021 Legislative Trends: Top Issues to Watch.” National Council on Compensation Insurance. 11 March 2021.

3. Thumula, Vennela; Liu, Te-Chun. “Topical Analgesic Use in Workers’ Compensation.” Workers Compensation Research Institute. 26 August 2021

4. Pollock, Ted. “Three key 2021 workers’ compensation trends to watch.” NU Property-Casualty 360. 18 January 2021.

5.Social Inflation: Evidence and Impact on Property-Casualty Insurance. The Institutes Risk & Insurance Knowledge Group. 20 June 2021.

6. Kersey, Laura.“2021 Legislative Trends: Top Issues to Watch.” National Council on Compensation Insurance. 11 March 2021.

7. Ibid.

8. George, Kimberly; Walls, Mark. “20 Workers Comp Issues to Watch in 2021.” IRMI. February 2021