Commercial Real Estate Insurance

Why choose Zurich for Commercial Real Estate insurance?

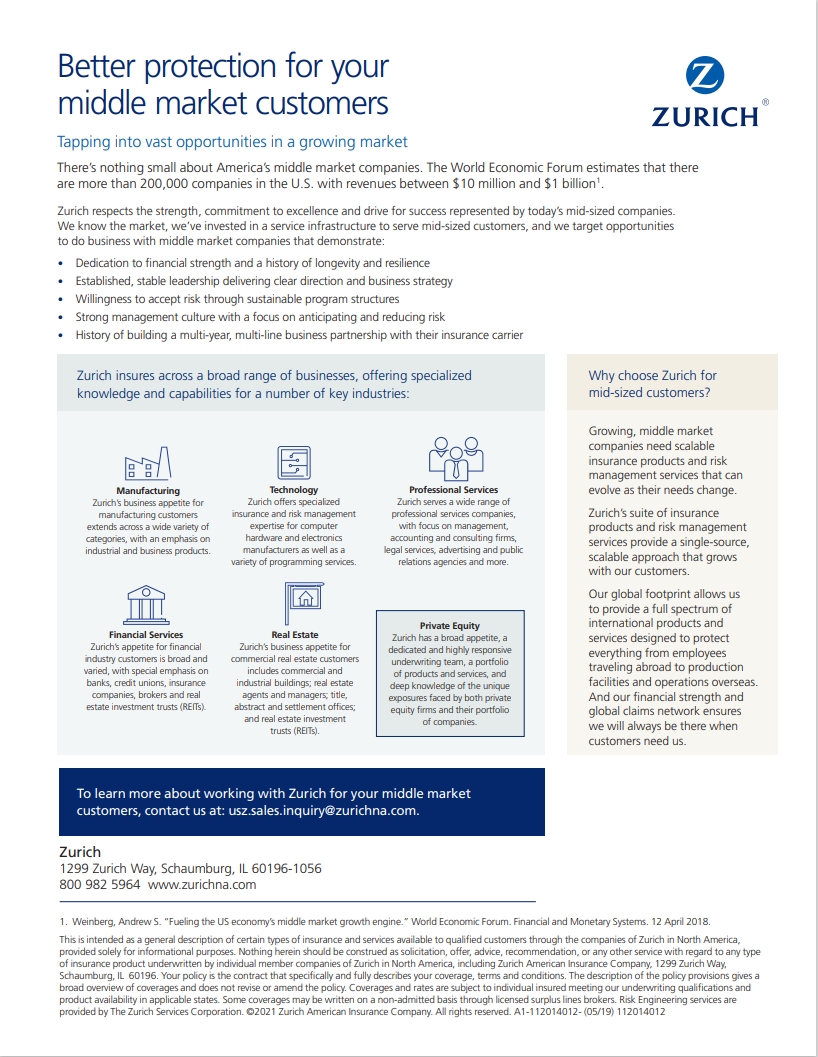

Zurich provides multi-line solutions for real estate firms, including Property, General Liability, Commercial Auto, Workers’ Compensation, Cyber, Employment Practices, Directors and Officers, Errors and Omissions, and Multinational.

Targeted classes for Commercial Real Estate

- Office

- Retail Trip Shopping Center

- Industrial

- Flex Research & Development

- Data Center

- Light Industrial

Real Estate resources

Insurance solutions for Commercial Real Estate

- Down Zoning Coverage

- Better GreenTM coverage to rebuild to same or higher green standard automatically included via sublimit after a covered loss

- Increased tax assessment after a covered loss

- Ordinance or Law applies to all covered property and time element loss, not just buildings

- Tenant relocation and replacement expense after a covered loss, including advertising costs

- Equipment Breakdown coverage

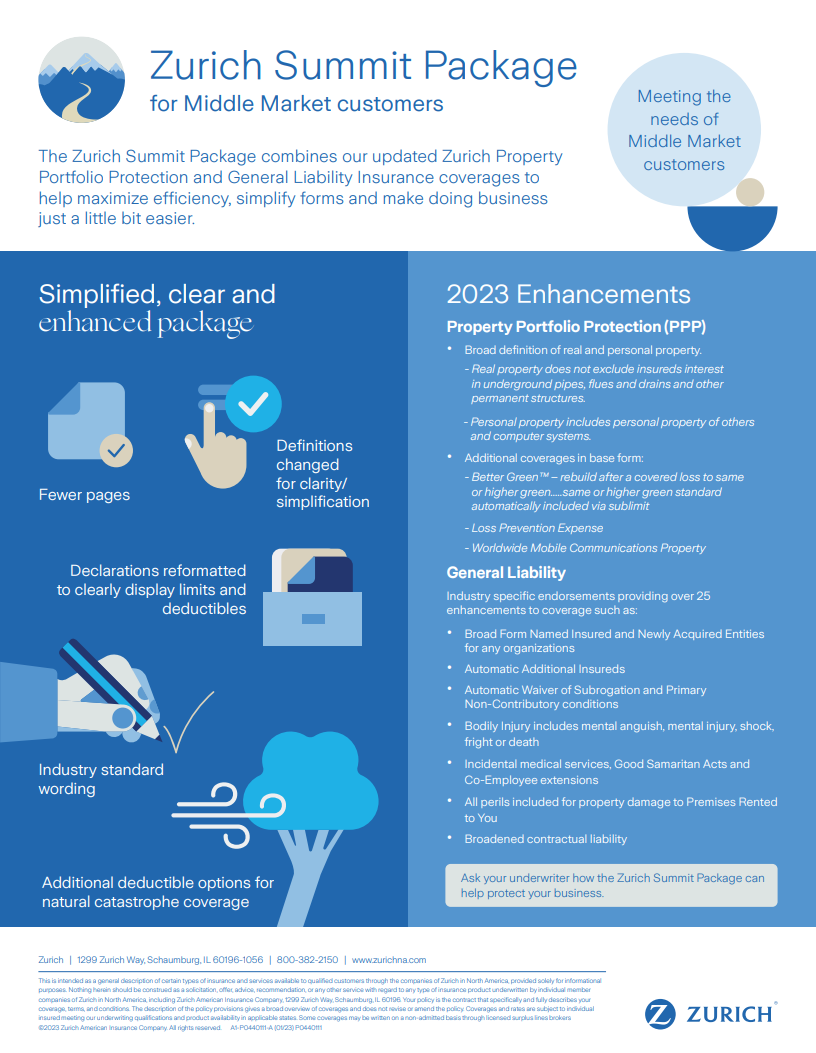

General Liability Industry specific endorsements providing 25 enhancements to coverage such as:

- Broad Form Named Insured and Newly Acquired Entities for any organizations

- Automatic Waiver of Subrogation and Primary Non-Contributory conditions

- Bodily Injury includes mental anguish, mental injury, shock, fright or death

- Incidental medical services, Good Samaritan Acts and Co-Employee extensions

- All perils included for property damage to Premises Rented to you Broadened contractual liability

- Automatic Blanket Additional Insureds status for vendors, lessees of premises, managers, lessors or governmental entities where required by written contract

Broadening coverage endorsement that adds 23 extensions in one form that includes:

- Loan/Lease Gap

- Employees as Insureds

- Fellow Employee

- Hired Car loss of use

- Hired Auto worldwide coverage

- Waiver of Subrogation when required by contract

- Level and variable dividend options available.

- Loss sensitive programs available.

- Pay-as-you-go payroll options.

- Coverage options for publicly traded, private and nonprofit companies as well as initial public offerings (IPOs).

- Every member of our D&O claims team is an attorney with broad knowledge of the current litigation environment and an understanding of global exposures.

- A global footprint that can deliver effective solutions for international programs of U.S.-domiciled multinational companies.

Zurich’s E&O insurance, also called Professional Liability Insurance, is designed to deliver solutions and peace of mind. We can help cover expenses associated with:

- Defense costs

- Court fees

- Settlements or judgements

- Crisis management

Zurich’s Cyber Insurance Policy helps address the cyber risks customers face. Our product helps customers respond rapidly to the impacts of cyber attacks, with advice and help from dedicated cyber risk professionals.

- Garagekeepers’ Liability

- Multinational Trip Travel

Risk Engineering

Through Zurich Resilience Solutions (ZRS), we provide specialized insights and tools to support our customers with solutions addressing traditional and evolving risks – above and beyond insurance.

Learn more

Claims Services

Zurich Claims specialists are strategically deployed in the U.S. and around the globe to help customers mitigate and respond to loss events, and to gain insights into becoming more resilient against future losses.

Learn more