Several trends that will impact the course of General Liability insurance in the years ahead

ArticleSeptember 20, 2021

by Alex Wells, Head of U.S. Middle Market, Zurich North America

This article is part of a four-part series focusing on the current and historical trends for various commercial insurance products. Other articles focus on commercial automobile, workers’ compensation and property.

Trends in Commercial Insurance, Issue 2 of 4: General Liability

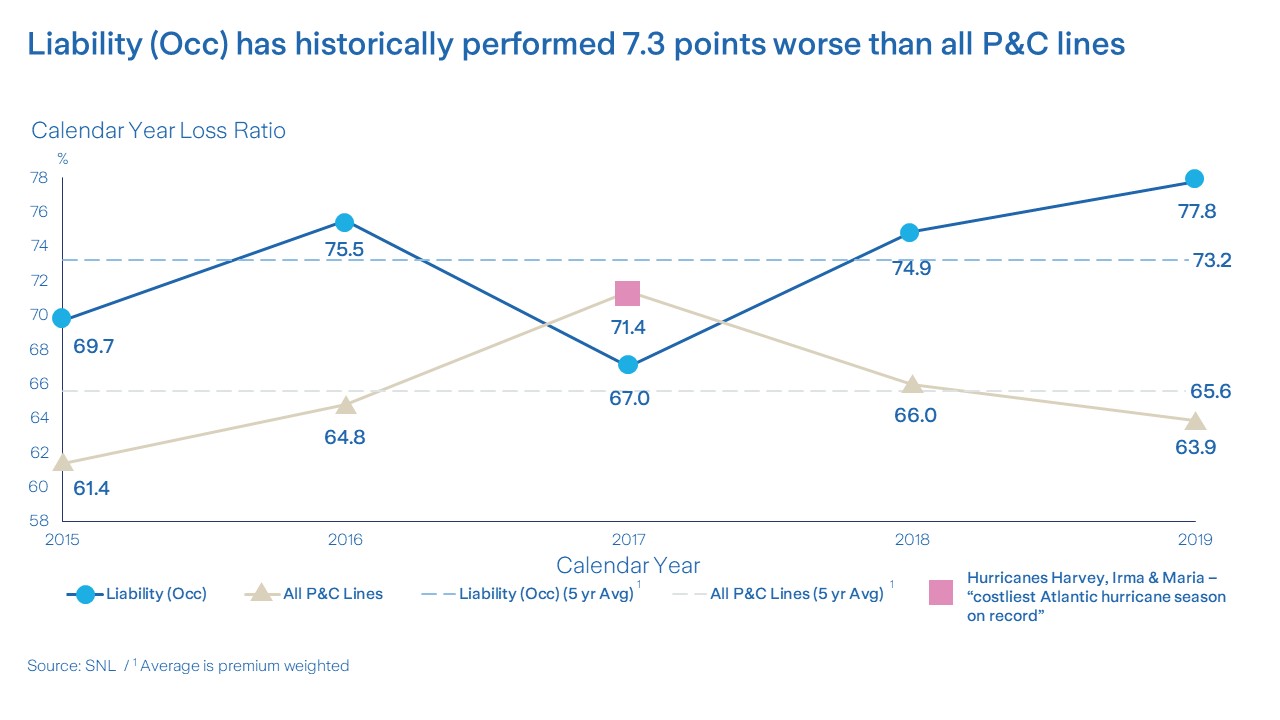

In my initial Trends in Commercial Insurance article, I explored six societal trends influencing the rate environment for commercial automobile insurance. An evolving liability environment is continuing to challenge the profitability of the auto line and is driving rate increases. As you might expect, auto is not the only category of commercial insurance being challenged by our changing society. Liability lines have seen a steady upward trend in calendar-year loss ratios over the past several years, necessitating rate increases by liability underwriters. Looking ahead, the property-casualty industry may experience additional stress on General Liability results due to a variety of potential headwinds over the next 12 to 18 months and beyond.

Future trends potentially impacting General Liability rates

In particular, following are several social and economic trends we are watching as potential drivers of a changing General Liability environment:

Medical cost inflation – Paying for the medical costs associated with an injury to a third party is one of the core coverages provided by General Liability insurance. The U.S. has a complex and expensive healthcare system that has seen an inflation rate far beyond the economy’s base inflation for decades. The Peterson Center on Healthcare and KFF (Kaiser Family Foundation) reported that, on a per capita basis, health spending has increased over 31-fold in the last four decades, from $353 per person in 1970 to $11,582 in 2019. In constant 2019 dollars, the increase was about six-fold, from $1,848 in 1970 to $11,582 in 2019.1

With continued advances in medical technology and treatments, there is no indication that this trend of accelerated medical cost inflation will subside. This medical inflation is a direct pass-through cost to the General Liability insurance coverage and drives much of the insurance cost increases over time.

Social inflation, litigation costs and litigation financing – The U.S. remains a highly litigious society, with signs that the environment may become even more challenging in the years ahead. Juries continue to be more open to awarding “nuclear verdicts” of seven figures and greater. A Willis Towers Watson report noted that punitive damages were up 20% over the five-year period from 2014 to 2019.2 It’s likely that a more recent study would show no lessening in this trend.

The pace of litigation is accelerating, driven in part by more frequent and widespread attorney advertising, employing all forms of marketing from television to digital, print and billboards seeking opportunities for actions on everything from auto accidents and medical malpractice to opioids and pesticides. In the third quarter of 2019 alone, the American Tort Reform Association (ATRA) estimated that more than $250 million was spent on nearly 3.7 million ads for local legal services or soliciting legal claims across the United States.3 And because so many cases were placed on hold during 2020, the tempo of attorney advertising is increasing substantially.

An additional driver has been the advent of a litigation finance business model. Litigation finance is the practice of third-party investor groups providing capital to law firms involved in personal injury and liability litigation in return for some financial recovery once lawsuits are resolved. This delivers the capital necessary for legal fees, operations, discovery and related expenses involved in liability litigation, and may be employed in financing mass torts. The leading player in this growing industry has funded 200 such investments since its founding in 2016.4

Cannabis – While many states have legalized possession and use of cannabis for medical and/or recreational purposes, marijuana remains a Schedule 1 drug under the federal government’s Controlled Substances Act (CSA). This means that manufacturing, possession, sale or use of marijuana remain federal crimes. The disparity between federal and state cannabis laws may cause issues regarding criminal liability in states where the sale and use of cannabis complies with state law but violates federal statutes.5

This dichotomy may also present thorny risk issues for insurers. Could carriers providing insurance to legal cannabis businesses be held criminally liable for aiding and abetting the sale of marijuana or for conspiring to violate the CSA, even when an insured’s business activity is legal under state law? Additionally, intrastate issues may also cause complications if marijuana is not uniformly regulated in different communities within a state.

PFAS – Per- and polyfluoroalkyl substances (PFAS) are a group of man-made chemicals used in a variety of industries around the world, including in the U.S. since the 1940s. These chemicals are persistent in the environment and can accumulate in living organisms, not breaking down over time. There is some evidence that these so-called “forever chemicals” can lead to adverse health effects.6

These chemicals may be detected in food packaged in PFAS-containing materials, commercial household products such as stain- and water-repellent fabrics, non-stick coatings on kitchen pots and pans as well as waxes, polishes and other common items. They are also present across a variety of workplaces, especially production facilities and industrial settings, and may be detected in drinking water on a localized basis, depending on a water source’s proximity to a facility where PFAS chemicals are used.

The persistence of PFAS chemicals in the environment, combined with the expanding litigation-industrial complex referenced earlier, suggests that this environmental risk may represent fertile ground for mass tort litigation in the years ahead.

Glyphosate – First registered as an herbicide in 1974, glyphosate has been widely used to control broadleaf weeds and grasses. The U.S. Environmental Protection Agency (EPA) has reviewed and reassessed its safety and uses under a program that reevaluates each registered pesticide on a 15-year cycle.7

In January 2020, the EPA released an interim decision for review of glyphosate that continues to find that there are no risks of concern to human health when glyphosate is used in accordance with its current label. However, despite an apparent lack of solid scientific evidence that glyphosate has properties detrimental to human health, its continued use is likely to drive civil litigation in the future.

Diacetyl – In 2000, the National Institute for Occupational Safety & Health (NIOSH) conducted an investigation at a microwave popcorn manufacturing plant in Missouri where a cluster of former employees had developed a rare lung disease.8 The majority of those with the illness had been exposed to mixtures of butter-flavoring chemicals used in the production of microwave popcorn. The investigation concluded that there was a risk for occupational lung disease in workers with inhalation exposure to flavoring chemicals such as diacetyl. With that, the term “popcorn lung” entered the vernacular.

Diacetyl is just one of many artificial flavorings used in food production. While these flavorings are known to be safe for consumers, continuous exposure to diacetyl in manufacturing facilities has been identified as an occupational health risk by NIOSH and OSHA. As these substances will continue to be used in food processing facilities, care must be taken by employers to ensure that workers are protected from potential adverse health effects, thus reducing the potential for significant liability claims.

5G technology – As 5G becomes more widespread, we are already hearing growing concerns from some corners about the potential for negative health effects associated with this new technology. Many will recall the concerns and litigation associated with electro-magnetic fields (EMFs) in the 1980s, specifically high-voltage overhead electrical lines. Despite conclusions that EMFs represented no measurable impact on human health, the fears have persisted. Today, the most common misperceptions about 5G – driven largely by misinformation spread on social media – are once again that radiations emitted by 5G technology may cause cancer, perhaps even weakening the immune system and enabling the spread of COVID-19.

Unfortunately, while extensive scientific evidence has shown that mobile phone technologies, including 5G, have no verifiable, adverse health impacts, Deloitte predicts that between 10% and 20% of adults in many advanced economies will mistakenly equate 5G with possible health effects. A Deloitte consumer poll in May 2020 found a fifth or more adults in six out of 14 countries polled believe that there are health risks associated with 5G.9 All of this suggests that litigation associated with 5G technology may become a factor in the liability environment looking ahead.

Nutraceuticals – Dietary supplements have long been targets of lawsuits over charges of false advertising claims and assertions of adverse health effects. Today, with the rapid expansion of supplements and ingestibles purported to contain cannabidiol (CBD), the nutraceutical litigation environment is changing.

Over the past several years, the FDA has issued several warning letters to firms marketing unapproved, new supplements reported to contain CBD.10 None of these products are approved by the FDA for the diagnosis, cure, mitigation, treatment or prevention of any disease, and the agency advises consumers to be aware when purchasing and using any such products. However, as the number of CBD-infused products grows, it is likely that the sale of nutraceuticals containing these compounds will generate new litigation in the future.

To control General Liability costs, know your risks

The cost of General Liability insurance coverage will increase over time for a variety of reasons, with medical inflation, social inflation and uncontrolled litigation costs driving current, visible costs. But the General Liability line is also the insurance coverage that always pays for the unexpected, emerging hazards such as those noted above. Medical costs are likely to continue their upward trajectories, while social inflation related to expanding litigation and mass torts are on a similarly problematic path.

These cost trends are largely outside the ability of any one insured to impact beyond active lobbying for legislative solutions such as tort reform. However, insurance rates may also increase due to a company’s individual loss history or the loss development of the specific industry class of that company. Proactive risk mitigation and engineering can dramatically improve an insured’s individual loss experience, but the customer’s industry class often plays a significant role in the cost of insurance for middle market-sized insureds who have relatively few losses. A company’s ability to articulate how they are “best in class” is critical in the final determination of their insurance costs.

Working with a strong insurance broker and carrier to perform periodic assessments of potential liability exposures by examining individual risk characteristics, as well as the risks a company may face simply by being part of a particular industry, is critical to building a partnership that will minimize the impact of the broader inflationary trends.

By keeping lines of communication open with key risk management partners, you will have a much clearer perspective on where you stand – and how you can improve your position – no matter the direction market trends may drive the costs for liability coverage and all other lines of insurance critical to a company’s success and sustainability.

References

1. Kamal, Rabah, McDermott, Daniel, Ramirez, Giorlando, Cox, Cynthia. “How has U.S. spending on healthcare changed over time.” Peterson KFF Health System Tracker. 23 December 2020.

2. Insurance Marketplace Realities 2019 – Casualty. Willis Towers Watson. 6 November 2018.

3. Legal Services Advertising. American Tort Reform Association. 2021.

4. Merken, Sara. “Legalist continues to bulk up team, adding Fox Rothschild, Casetext alums.” Reuters. 11 June 2021.

5. Messina, Charles J.; Pierre, Daniel. “The high risk of insuring cannabis.” Property/Casualty 360. 5 November 2020.

6. Basic Information on PFAS. Environmental Protection Agency. 4 April 2021.

7. Glyphosate. U.S. Environmental Protection Agency. 13 March 2021.

8. Flavorings-Related Lung Disease: Exposures to Flavoring Chemicals. The National Institute for Occupational Safety & Health (NIOSH). Centers for Disease Control and Prevention (CDC). 3 October 2017.

9. Lee, Paul; Westcott, Kevin; Wigginton, Craig; Calugar-Pop, Cornelia. 5G is not hazardous to your health: Busting the radiation-risk myth. Deloitte Insights. 7 December 2020.

10. Warning Letters and Test Results for Cannabidiol-Related Products. U.S. Food & Drug Administration. 5 August 2021.