Insurance for Manufacturers

Why choose Zurich for Manufacturing insurance?

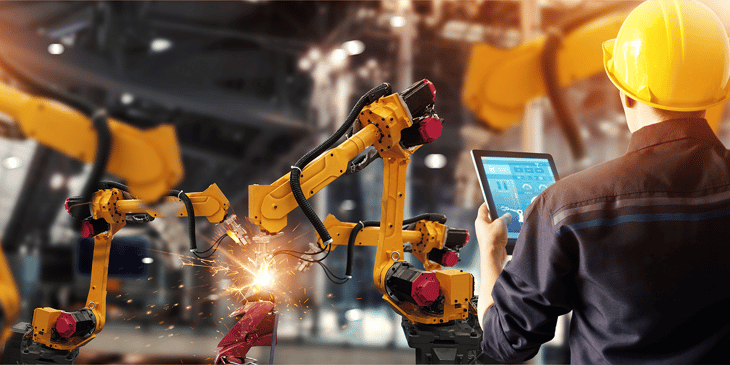

Many manufacturers are grappling with rapid change due to artificial intelligence, workforce skills gap, and sustainability efforts. They need an insurance provider that understands these opportunities and the associated interconnected risks.

Our unsurpassed global capabilities, holistic approach, and tailored services help manufacturers navigate and develop effective, forward-looking strategies that bridge the gap and solve for the risks of tomorrow.

Zurich Resilience Solutions and SpearTip, a Zurich company, can help develop a robust cyber risk mitigation plan that includes front-end network vulnerability identification to monitoring, detecting, and managing a cyber event. Learn more about steps you can take to strengthen your plan.

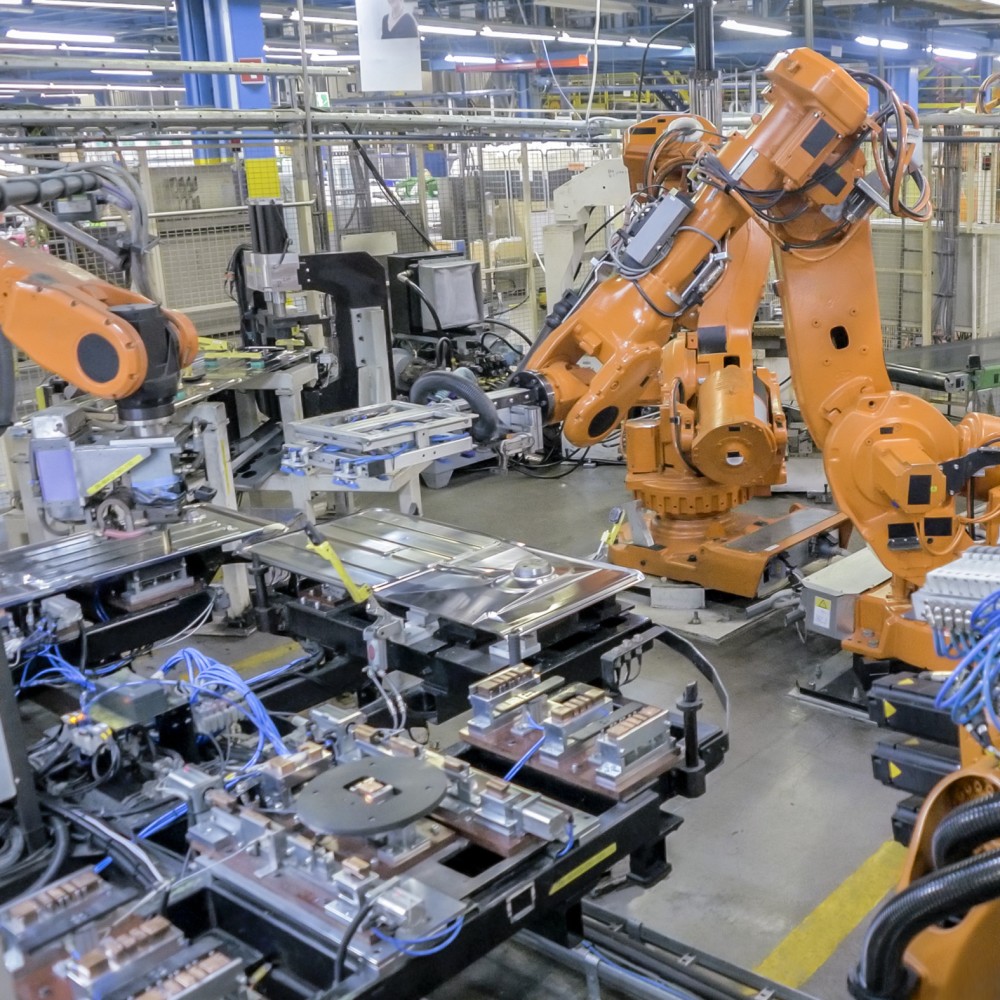

Targeted classes for manufacturing

- Metal Stamping

- Commercial Equipment and Component Manufacturing

- Metalworkers

- CNC Machine Shops

- Hardware and Tooling

- Commercial Grade Electrical Equipment

- Motor Vehicle Component Parts

- Textile and Apparel Manufacturing

- Plastics Manufacturing

- Paper Products Manufacturing and Printing

- Limited Food Appetite including Bakeries, Cookies, Crackers & Dry Pasta

- Federal Government Contractors

Manufacturing resources

Insurance solutions for manufacturers

The Property Portfolio Protection (PPP), Zurich’s broad all-risk Property form, addresses exposures that manufacturing companies face. Coverage highlights include, but are not limited to:

- Broad definition of real and personal property

- Real property does not exclude insureds interest in underground pipes, flues, drains and other permanent structures

- Personal property includes personal property of others and computer systems.

- Equipment breakdown coverage is included with no sublimit

- Ordinance or Law applies to all covered property and time element loss, not just buildings

- Better GreenTM – coverage to rebuild to same or higher green standard is automatically included via sublimit after a covered loss

- Loss of Utilities includes overhead lines

- Business Interruption additional coverages Ingress/Egress and/or Civil Authority can include flood and earthquake for covered locations

- Natural catastrophe limits and deductibles are scheduled on declaration page and not subject to revision at time of loss

General Liability Industry specific endorsements providing 25 enhancements to coverage such as:

- Broad Form Named Insured and Newly Acquired Entities for any organizations

- Automatic Additional Insureds

- Automatic Waiver of Subrogation and Primary Non-Contributory conditions

- Bodily Injury includes mental anguish, mental injury, shock, fright or death

- Incidental medical services, Good Samaritan Acts and Co-Employee extensions

- All perils included for property damage to Premises Rented to You Broadened contractual liability

Covers manufacturing mistakes or negligent service resulting in third-party financial loss not covered under traditional General Liability Insurance.

Manufacturers’ Errors and Omissions (E&O)- Level and variable dividend plans

- Loss-sensitive programs

- Pay-as-you-go payroll solutions

One of the industry’s largest networks, providing coverage in 200+ countries and territories

- Regionally based multinational Underwriting teams with expertise in navigating foreign legal,licensing and tax requirements

- 3,000+ dedicated multinational experts worldwide

- 7,500+ claims experts globally with 550 certified in handling multinational claims

- 950+ Risk Engineers and Consultants

Risk Engineering

Through Zurich Resilience Solutions (ZRS), we provide specialized insights and tools to support our customers with solutions addressing traditional and evolving risks – above and beyond insurance.

Learn more

Claims Services

Zurich Claims specialists are strategically deployed in the U.S. and around the globe to help customers mitigate and respond to loss events, and to gain insights into becoming more resilient against future losses.

Learn moreFAQs

Manufacturers that should consider commercial insurance for protection include:

- Commercial Equipment manufacturers

- Component manufacturers

- Metalworkers

- CNC machine shops

- Hardware and tooling manufacturers

- Metal stamping operations

- Commercial grade electrical equipment manufacturers

- Motor vehicle component parts manufacturers

- Textile and apparel manufacturing

- Plastics manufacturers

- Paper products manufacturing

- Printing companies

- Federal government contractors