Insurance for Private Equity Portfolios

Why Zurich for private equity insurance?

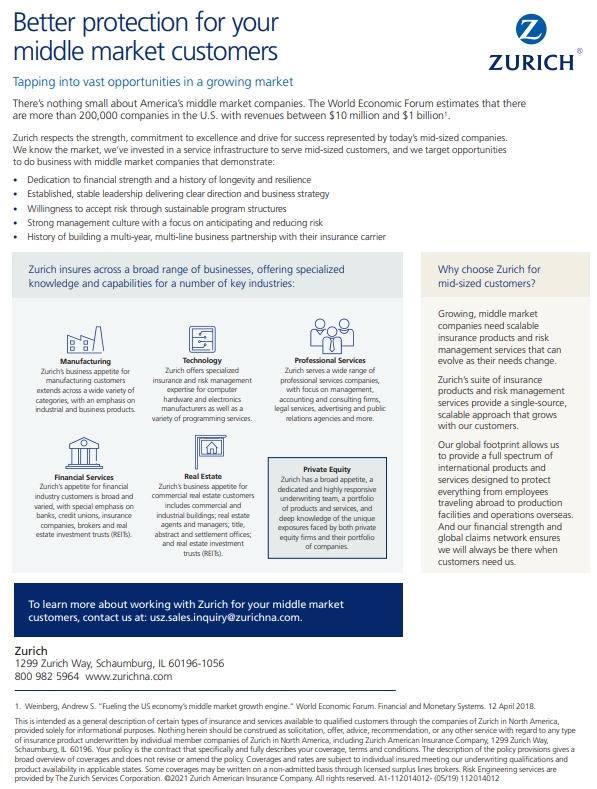

Executing mergers and acquisitions (M&A) in today’s environment means dealing with a multitude of economic, legal and regulatory challenges while moving with the speed and agility that such deals demand. Zurich’s dedicated and experienced Private Equity insurance specialists have the necessary efficiency and expertise to deliver on these complex risks and emerging issues to help mitigate their potential impacts on your firm and portfolio companies.

Zurich's Private Equity professionals provide access to a comprehensive suite of insurance solutions encompassing property, casualty, liability, captive products and services. Zurich can deliver solutions and services to the entire portfolio of companies — protecting capital assets with the continuity and breadth of a unified risk management strategy.

Targeted Industries for Private Equity

Private Equity resources

Insurance solutions for Private Equity

Coverage for mid-size businesses doing business abroad or planning to leverage opportunities beyond their national borders.

Having the right people matters – the right risk experts, underwriters, claims handlers, captive professionals and service specialists. Because responsive multinational insurance solutions and world-class service for you are powered by exceptional people, worldwide.

- 200+ territories

- 8,500+ international programs

- 3,000+ dedicated multinational experts worldwide

- 900+ certified underwriters for multinational business

- 950+ risk engineers and consultants

Meet our Private Equity specialist

Bill Fahy

Head of Private Equity, General and Developing Industries

U.S. Middle Market

william.fahy@zurichna.com

Ready to do business, but don't have a broker? Find a broker

Risk Engineering

Through Zurich Resilience Solutions (ZRS), we provide specialized insights and tools to support our customers with solutions addressing traditional and evolving risks – above and beyond insurance.

Learn more

Claims Services

Zurich Claims specialists are strategically deployed in the U.S. and around the globe to help customers mitigate and respond to loss events, and to gain insights into becoming more resilient against future losses.

Learn moreFAQs

Private equity insurance is both commercial insurance products and risk mitigation and claims services customized to the needs of the private equity firm’s portfolio of companies. These products and services are built to protect against a wide range of risk exposures that can lead to litigation and/or losses. Although private equity firms can gain substantial benefits when acquiring portfolio companies, those acquisitions sometimes come with potential risks, such as lawsuits, regulatory challenges, reputational damages and vulnerability to a changing investment climate.

Insurance solutions designed and delivered with the speed, accuracy and response that fast-moving private equity deals demand can help private equity firms mitigate potential risks, allowing them to focus on the complexities of managing their diverse business operations.