Is a vehicle service contract right for you?

AutomotiveArticleAugust 5, 2024

You manage personal risks every day. When you obey traffic laws to help prevent collisions, lock your car doors, or avoid driving in rough weather, you are acting to protect yourself and your vehicle. But there are some situations where protecting yourself and your vehicle isn’t easy. For example, what if your engine has a mechanical breakdown and your warranty is expired? Paying for repairs out of pocket can be unpredictable and costly.

With a vehicle service contract (VSC), you can enjoy a more worry-free driving experience. After all, your vehicle is one of the more expensive purchases you’ll make in your lifetime. A VSC helps eliminate the worries that come with car ownership, allowing you to remain confident that vehicle protection is available long after you get the keys.

How is a VSC different from the manufacturer's warranty?

A manufacturer’s warranty is included in the purchase of a new vehicle and is described as providing bumper-to-bumper repairs for a predetermined amount of time or mileage. The typical warranty is three years or 36,000 miles, whichever comes first. After the manufacturer’s warranty expires, you’re on your own when it comes to most repairs. That is, unless you choose to extend your coverage by purchasing a VSC.

A vehicle service contract (VSC) is not a warranty. It is a service contract that covers parts and labor. It provides coverage beyond the manufacturer’s warranty and can offer additional benefits such as roadside assistance, transportation reimbursement, and food/lodging costs associated with car repairs while traveling. These extra perks can help relieve the stress associated with vehicle breakdowns — close to home or miles away.

VSCs allow you to customize coverage based on your driving habits, lifestyle and budget. Most service contracts are available for both new and pre-owned vehicles and offer different coverage levels. You may only want to cover the bigger ticket items like the transmission and engine, or maybe you’re looking for more comprehensive coverage. Most providers offer several plan options so you can choose the coverage that is right for you. Plus, you will typically have a variety of term and mileage options, allowing you to choose the amount of time or miles to have your vehicle protected.

Another benefit of the VSC is that, should your vehicle require a repair, you can choose to have your vehicle repaired at your local dealership or any ASE-certified repair facility. So, whether you’re in town or far from home, you’re covered. In most cases, the VSC administrator will also pay the repair facility directly, eliminating the inconvenience and hassle of requesting reimbursement.

Why VSCs are more important than ever

Vehicle owners may benefit from a VSC for different reasons. Are you someone who has a lengthy commute to work? You’ll likely reach your mileage limit before the manufacturer’s warranty expires. If you want at least three years of coverage, it might make sense for you to purchase a VSC. For those who frequently take road trips, the benefits provided with a VSC, such as roadside assistance, trip interruption coverage and alternate transportation reimbursement, can add even greater value.

Perhaps you're looking to purchase a pre-owned vehicle that doesn’t come with any limited warranty. A VSC can increase your confidence in the purchase, or maybe you’re just someone who doesn’t want to risk any budget surprises. A VSC can be a safety net, providing reassurance that something is there to protect your vehicle — and your budget — from unexpected expenses.

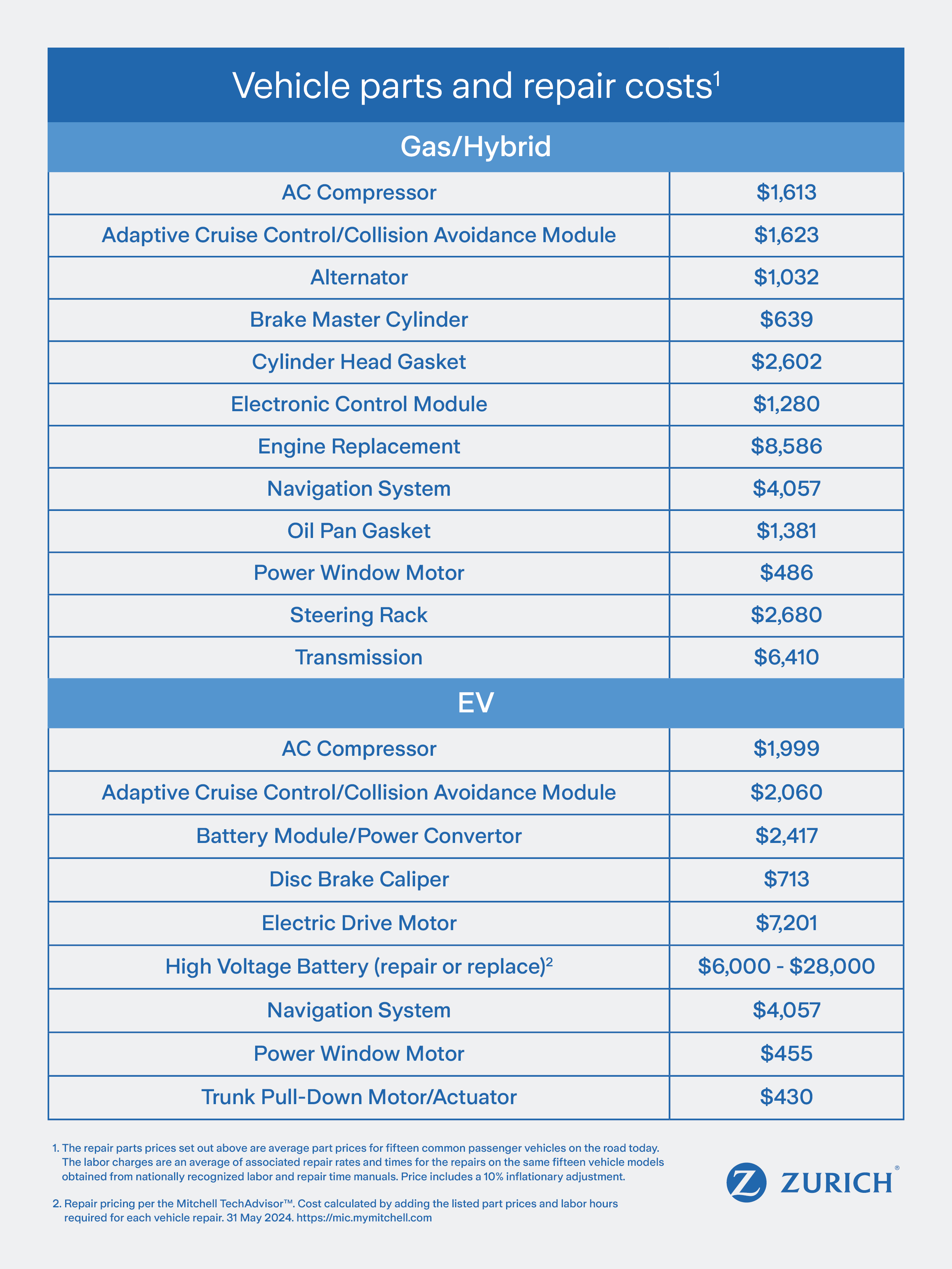

As manufacturers continue to develop vehicles with advanced technology and safety features, parts and labor costs are also increasing. In fact, the average annual cost of owning and operating a new vehicle is more than $12,000, according to the American Automobile Association (AAA).1 A VSC can help protect you from the risks associated with driving a new vehicle and the complex technology that comes with it. For those who own or are considering a high-end luxury vehicle, a VSC may provide even greater value.

Electric vehicles (EVs) can further raise the cost of repairs. Even though EVs have fewer moving parts, the technology is so advanced that both a computer programmer and auto technician are often needed to work on the vehicle. And the high voltage EV battery can be quite expensive to repair or replace. Costs could range from $6,000 to $28,000 or more.2

Labor and repair costs will undoubtedly continue to grow for all types of vehicles, ultimately increasing the value of purchasing a VSC.

Are drivers satisfied with their VSCs?

In a recent study of people who bought VSCs, 82% reported satisfaction with the product and 75% would recommend a VSC to someone.3 When considering a VSC, think about your own driving needs and habits — where and how often you drive, how long you plan to keep your vehicle, and road/environmental conditions. With these variables in mind, along with your desire to protect your budget, you can make an informed decision if a VSC is right for you.

Why choose a VSC from Zurich?

With Zurich’s 40+ years of experience providing vehicle protection products and a 4.5/5 stars rating by ConsumerAffairs,4 you can be confident in the quality and reliability of our coverage. Zurich Vehicle Service Contracts are widely accepted by repair facilities across the country, which makes for a more convenient repair process. As a leading provider of vehicle protection products, Zurich paid more than $226 million in vehicle protection product claims in 2023, and more than $849 million from 2019-2023.5 Simply put, Zurich VSCs can help protect your vehicle from the unpredictable.

Zurich’s VSCs are also transferrable. If you decide to sell your vehicle within your VSC terms, the remaining coverage can be transferred to the new owner, enhancing the resale value.

For even more customization, Zurich offers an array of vehicle protection products to fit your needs and preferences. From covering dents and dings to brake and technology system repairs, Zurich has a protection plan you can rely on. Learn more about VSCs and other vehicle protection products from Zurich here.

1. AAA Newsroom. “Your Driving Costs 2023.”

2. Repair pricing per the Mitchell TechAdvisor™. Cost calculated by adding the listed part prices and labor hours required for each vehicle repair. 31 May 2024. https://mic.mymitchell.com

3. Durkin, Thomas A., Gregory Elliehausen and Thomas W. Miller, Jr. “Service Contracts on Vehicle Purchases: Findings from a New Survey.” Social Science Research Network. 22 June 2023.

4. ConsumerAffairs. “Zurich Vehicle Service Contract Reviews.” 11 July 2024. https://www.consumeraffairs.com/insurance/zurich-north-america.html

5. Zurich paid vehicle protection product claims 1-1-2019 through 12-31-2023, excluding Universal Security Guard® and Guaranteed Auto Protection.