Why AI may be good for the insurance industry

Technology and AIArticleJune 14, 2023

Artificial intelligence is definitely coming, but it’s not going to replace humans in the property/casualty industry. That was one of the messages during an engaging panel discussion at Insurtech Insights in New York.

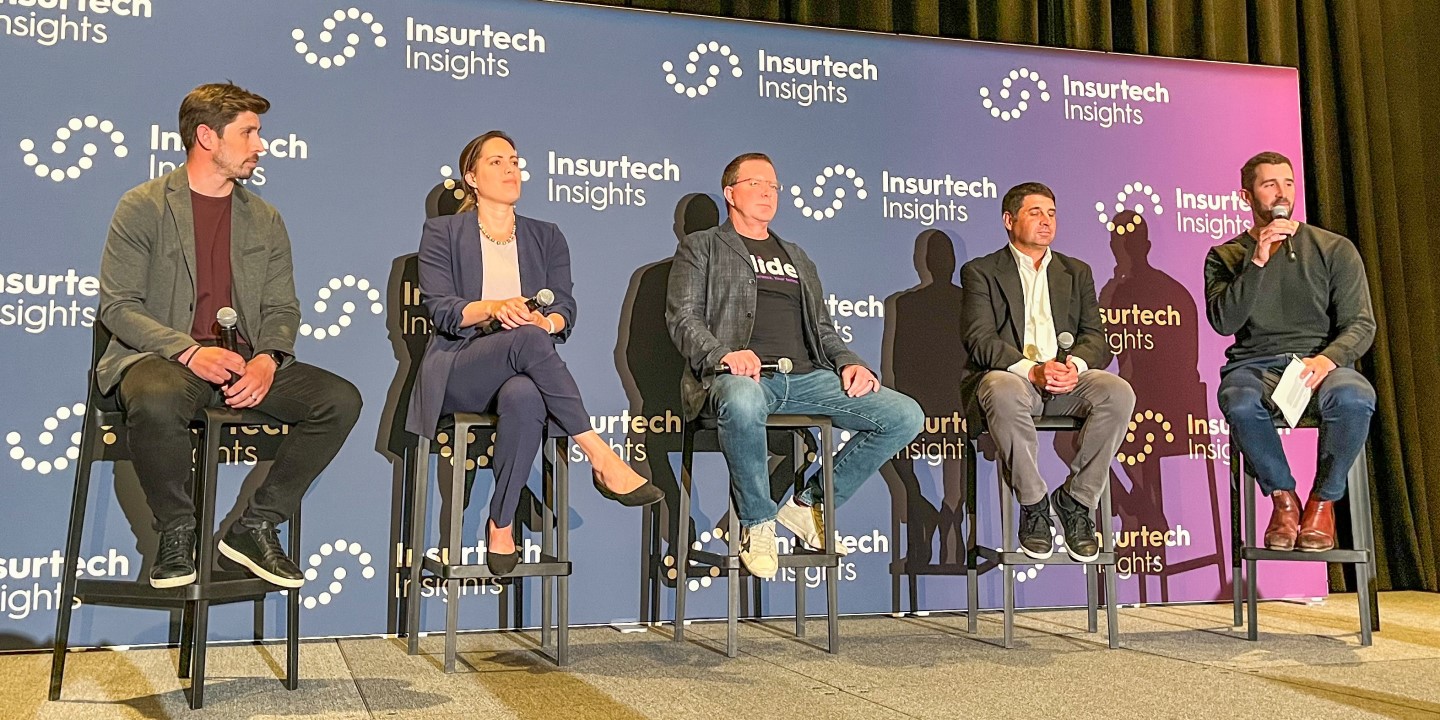

The two-day annual conference took place beneath the orange haze of smoke that had made its way from wildfires in Canada. Inside the Javits Center in midtown Manhattan, however, the future of the property/casualty industry was made crystal clear by the four panelist who graced the stage.

The title of the session on June 7 was, “A look into the crystal ball: Navigating the P&C value chain of 2030.” It promised to address telematics, the sharing economy and other new trends impacting the P&C industry, but the focus of the discussion was on the use of data and artificial intelligence (AI) to better serve customers and make insurance provider more efficient.

Jennifer Hobbs, VP, Lead Data Scientist, Zurich North America, said the speed at which AI is developing is allowing insurers to move from detect-and-repair to predict-and-prevent.

“Data analytics has come a long way in the past seven years,” she said. “We’ve really seen an explosion in the amount of data that we have. I think that’s going to continue in the next seven years, into 2030. Really, the change that we’re looking at is around moving from structured tabular data into these exciting unstructured sources like video and imagery and text, and using that to improve our business across the value chain.”

Hobbs was joined on the panel by Kyle Nakatsuji, co-founder and CEO, Clearcover; Bruce Lucas, Founder and CEO, Slide Insurance; and Andy Cohen, President, Snapsheet. The panel was moderated by Connor Love, Partner, Lightspeed Venture Partners.

The panelists talked about the possibility of the entire insurance process going fully automated, from underwriting the risks to settling the claims. But they all agreed that humans will always play a role, because AI won’t be able to fix a car or repair a home. Also, current laws restrict most insurance services in the absence of humans.

Hobbs said that humans will remain “in the loop” so that there’s always a touchpoint.

“The promise of AI is to make the human efficient, more engageable, that we can put the information that they need to do their job better right in their hands — so that it’s not a manual search process,” she said. “They can have all of this information, all of this data, all of these tools right at their fingertips, and really let them do their jobs better, not to eliminate them from the process.”

Building trust with customers is important as AI or any new technology is introduced to the process, Hobbs said.

“Part of that, also, is the burden on us, the people developing the analytics and the models to use techniques that are interpretable and explainable, so that we can bring the end user along on the journey and establish that trust, and that it’s not some black box making a decision without a human to help provide insight and explanation.”